Feel the Fear, Profit Anyway

In 1998, the “smartest guys in the room” blew themselves up.

Long-Term Capital Management—run by Nobel Prize winners—was leveraged to the gills.

Russia defaulted, the trades collapsed, and Wall Street braced for Armageddon.

Panic everywhere.

Phones ringing off the hook. Headlines screaming “Systemic Collapse.”

But here’s what you didn’t see on CNBC: while everyone was unloading positions at any price, a few players were stepping in to buy. They didn’t know exactly how it would end—only that fear had forced prices far below reality.

And when the Fed cut rates and the panic flipped, those positions exploded higher.

Although it gives people PTSD when I bring it up…

The same thing happened in 2009.

Banks looked finished. Citi at a buck. Bank of America at three. Every headline said “nationalization.” But people like David Tepper started buying anyway. (He later said it felt like he was bidding alone in an empty room.)

Then the government backstopped the banks. Prices went vertical. His fund made billions.

Here’s the pattern: it’s not the bailout that made the trade. It was the panic. The bailout was just the spark that flipped the trade. Big money is ALWAYS made by standing ready while everyone else is puking shares.

I’ve got a friend who’s been exploiting these setups for decades. He can spot them better than anyone.

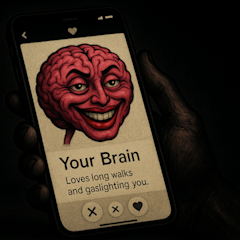

He doesn’t bother predicting what the Fed or regulators will do. He studies where fear (or greed, or panic, or stupidity) has created formations that are stretched to breaking. When that happens, the reversals are almost always violent.

I like to think of these moves as supernovas—the kind of trades that start as quiet accumulations and end as brutal explosions.

Although these supernovas erupt during major crises, you’ll find smaller ones every week in individual stocks. Why? Because human behavior doesn’t change. Mispositioning is everywhere.

Fear drives as many trades as greed—and that’s what fuels the setups.

BUT the setup that has me excited right now is different.

Why? Because it’s in a sector primed for an infestation of supernovas.

Why AI… Why Now?

Again, these moves are rare. But when they happen…

They don’t crawl higher. They detonate. The bigger the base, the higher in space.

And right now, the conditions for detonation are here again.

Which brings us back to AI. Six months ago, everyone wanted to own it. Today, many names are treated like landmines.

That’s the fuel.

Because underneath that fear, a HUGE setup is coiling in one stock in particular.

It’s not about the Fed, or GDP, or some grand narrative. It’s about where the crowd is leaning too far and where the market flips. And right now, the crowd is leaning the wrong way in AI.

All it takes is a tiny spark. One piece of good news. One unexpected breakthrough. One earnings beat. One shift in the narrative. One viral tweet.

Prices rip.

It’s the same pattern we’ve seen again and again.

Fear creates the setup. Positioning coils the spring. And the explosion—when it comes—doesn’t give you time to tiptoe back in.

That’s why one of the smartest guys I know is zeroed in on AI right now. Because when this one blows, it won’t be a grind. It’ll be a supernova.

And it's all set to begin TOMORROW, September 24.

Doug and I just sat down with him to break this down. He laid out how the setup works, why it’s happening in AI today, and—at the end—he gave away one of his supernova trades for free.